In anticipation of the routine opening of the red box, here are five measures households can expect for Chancellor Rachel Reeves’ upcoming Autumn Budget.

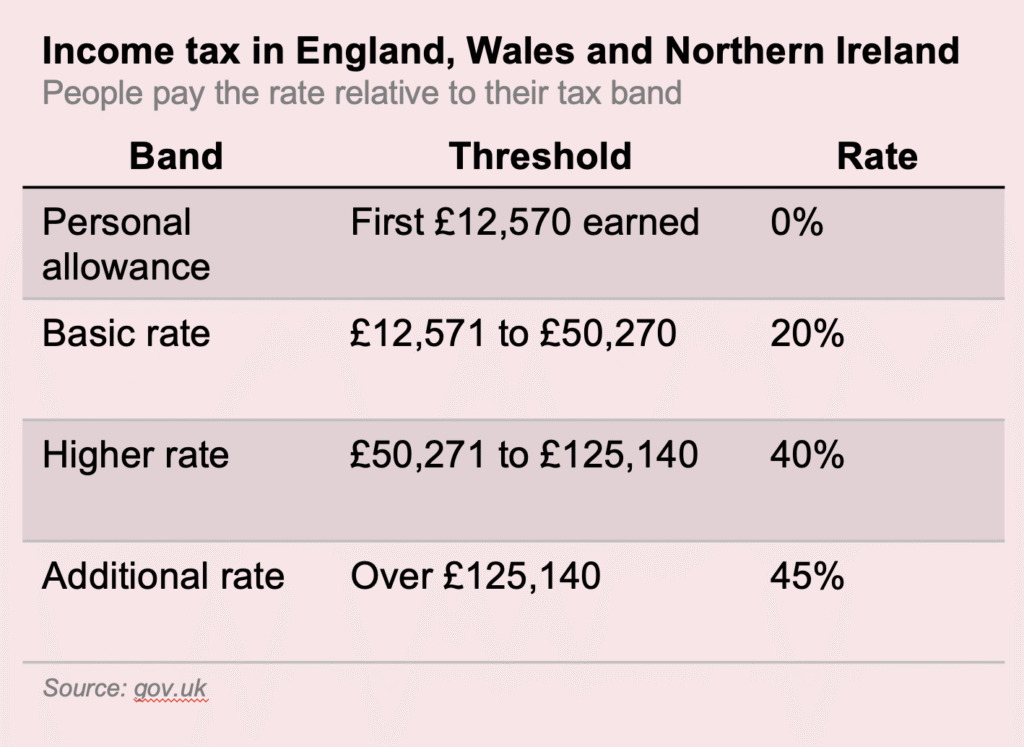

- A freeze on income tax thresholds

A move originally broken by the Financial Times, Reeves earlier this month pivoted from her manifesto-breaking decision to raise income tax.

In its place, it is expected that the chancellor will prolong the freeze on income tax thresholds in England, Wales and Northern Ireland beyond the standing 2028-29 deadline.

Freezing thresholds implies that, as salaries increase over time with inflation, more people will reach a level of income of which they are required to start paying tax. Additionally, people will also have to start paying higher taxes.

- ISAs (Individual Savings Accounts)

Chancellor Reeves has been widely speculated to cut the annual ISA cash limit in her budget to £12,000 in her Budget as she attempts to redirect consumer and investor interest back to the stock market.

This means an average ISA holder will be able to invest less money into their savings.

As reported by the Financial Times, people close to preparations for the upcoming Budget said Reeves had decided to reduce the limit from the current level of £20,000 but slightly higher than the £10,000 cap that had been considered.

- Property

Reeves is planning to usher in a new “mansion” tax to homes in England valued over £2m, as reported by the Times and the Independent.

The tax is estimated to affect around 100,000 homes with an average surcharge of £4,5000, according to the Times.

Paula Higgins, CEO at HomeOwners Alliance says “a ‘mansion tax’ hits ordinary family homes in London and the Southeast far more than the rest of the UK.”

- Pensions

The chancellor is planning to raise about £2bn, with some speculating £3bn – £4bn on tax raid on pension schemes

The plan would greatly reduce the amount of money people can sacrifice from their salary to invest in their pension pots without paying national insurance.

- Energy costs

Rumours surrounding ministerial plans to cut annual energy bills by as much as £200 per household in the Budget. A crucial move in chancellor Reeves’ promise to tackle Britain’s ongoing cost of living crisis by bringing down inflation.

One way in which Reeves is planning to lower bills is by scrapping the 5 per cent value added tax (VAT) from gas and electricity bills.